Summary August 2022

- A bumpy month for crypto assets with BTC down -14%

- Institutional crypto adoption continues with positive headlines from Mastercard, Blackrock, and Instagram

- Ethereum closes a very volatile month, down -7% after initially climbing more than 15%

- Central banks’ reaffirmed hawkishness still holding back both traditional and crypto markets

Market Review

Central banks and legacy financial markets

Traditional US equity markets rebounded strongly in the first half of the month driven by a lower-than-expected US CPI print. However, the supposed “bear market” rally fizzled out towards the end of the month. Last week’s speech by FED chair Powell at Jackson Hole reminded investors that the FED’s primary focus is still on taming inflation and cautioned against “prematurely loosening policy”. Since then, equity markets, long duration assets, and bitcoin have corrected sharply to the downside.

Crypto Assets

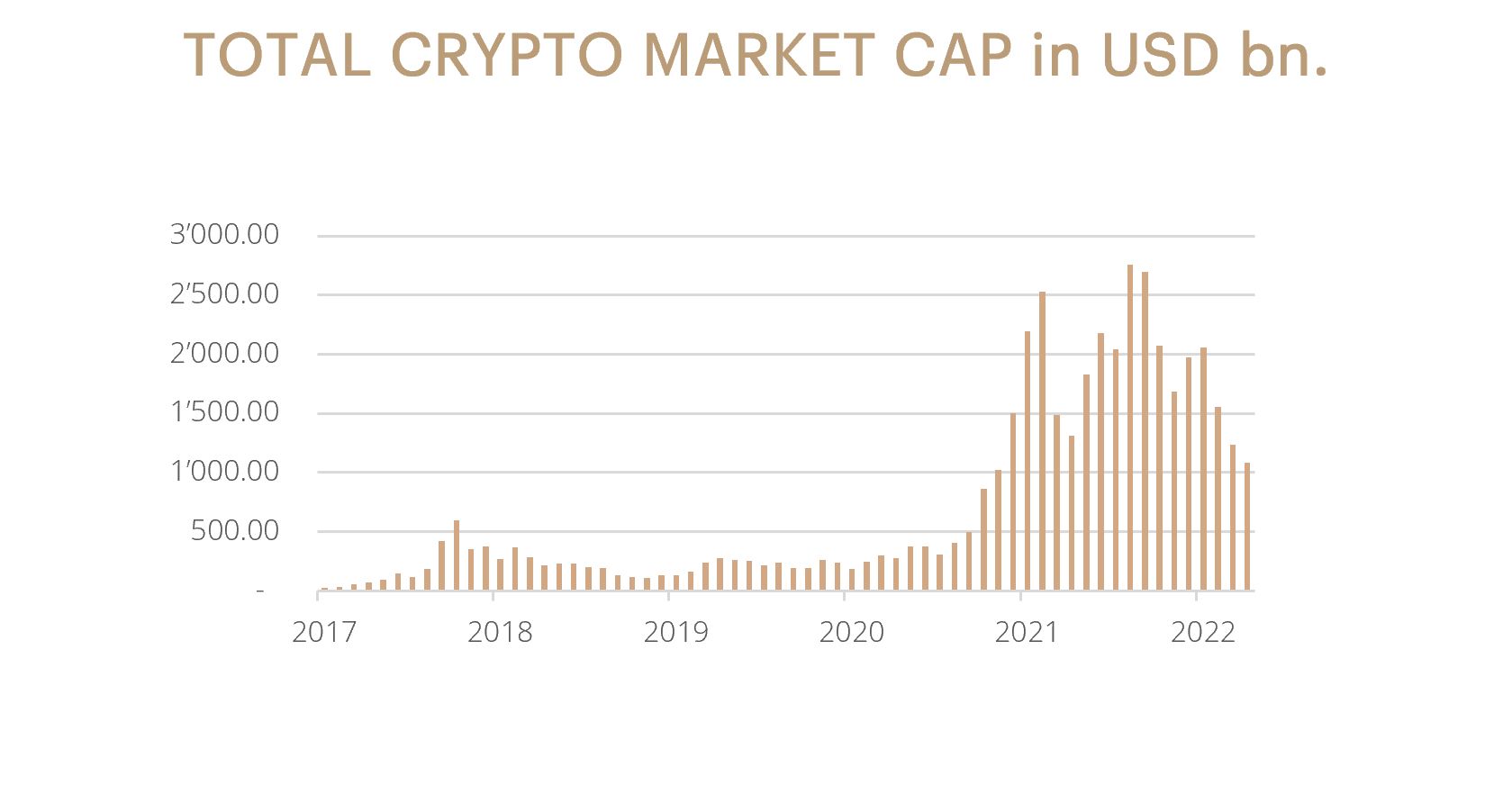

During the first two weeks of August, bitcoin and other crypto assets resumed their July rebound. Bitcoin even flirted with the USD 25k price level. Ethereum performed especially well, predominantly driven by anticipation of the upcoming Ethereum merge date. It hovered briefly above the USD 2,000 price level. Towards the end of the month, crypto prices declined in line with equity markets, while bitcoin dropped below 20k for a short period of time. Overall, it was a negative month for crypto assets with bitcoin losing more than -13% since the end of July.

Ethereum Merge

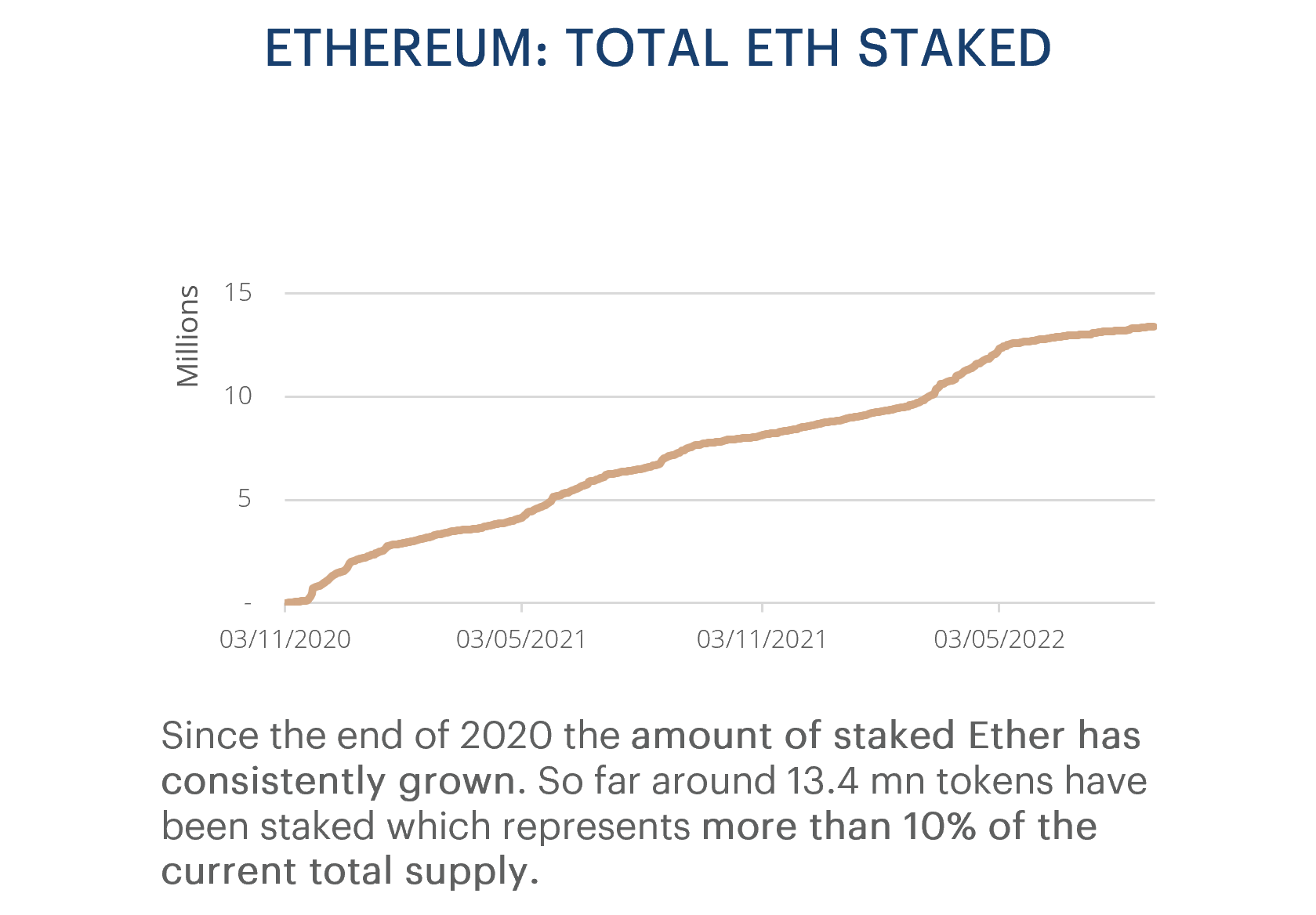

In mid-September, Ethereum will carry out the long-in-the-making “Merge” with the main goal of switching to a less energy intensive proof-of-stake consensus mechanism. A successful transition would have multiple implications for current and future investors. After the merge, the network energy consumption is expected to drop by more than 99%. The Ethereum foundation estimates that to run the Ethereum network only around 0.01 TWh will be needed per year. As a comparison: the entire PayPal payment system consumes approximately 25 times more energy per year. In addition to this, staking yields will now also include block rewards, and will likely range from 8% to 12% p.a., though it is still unclear when investors will be able to withdraw staked coins.

The merge does entail some challenges. A minority of the Ethereum community, mostly miners, are resisting the merge with the aim to “fork off” a proof-of-work version. This potential fork or chain split could result in duplicate assets of which one preserves its proof-of-work characteristic. Depending on the community support for this fork, temporary technological vulnerability risks cannot be excluded. Overall, though, we think there is only a small chance that the merge will be unsuccessful.

Outlook

We believe that the “Ethereum Merge” is one of the most crucial events ever in the crypto asset space. A successful merge, combined with a moderate 50 bps rate hike decision by the FED, which would come to pass shortly after the Ethereum merge date, could potentially initiate more bullish sentiment amongst investors. Furthermore, a successful merge could attract investors who were to date restricted from investing in Ethereum due to strict ESG criteria. The merge would drastically reduce energy consumption.