Crypto maintained tight ranges last week as the macro outlook worsened, with BTC and Alts outperforming TradFi risk assets

Once again, the past week was slow, with tight liquidity. Looking ahead to this week, US non-farm payrolls data will be released (cons: 250k, prev: 315k), which will serve to help assess how Fed Policies are impacting the real market, and whether the Fed will slow down with its “Quantitative Tightening” programme.

Some macro events that I am following closely are the following:

- EU banking concerns (CS and DB)

- UK bond market and political actions

- Military developments in Ukraine

Liquidity scarcity is in my opinion one of the major issues that central banks are currently facing.

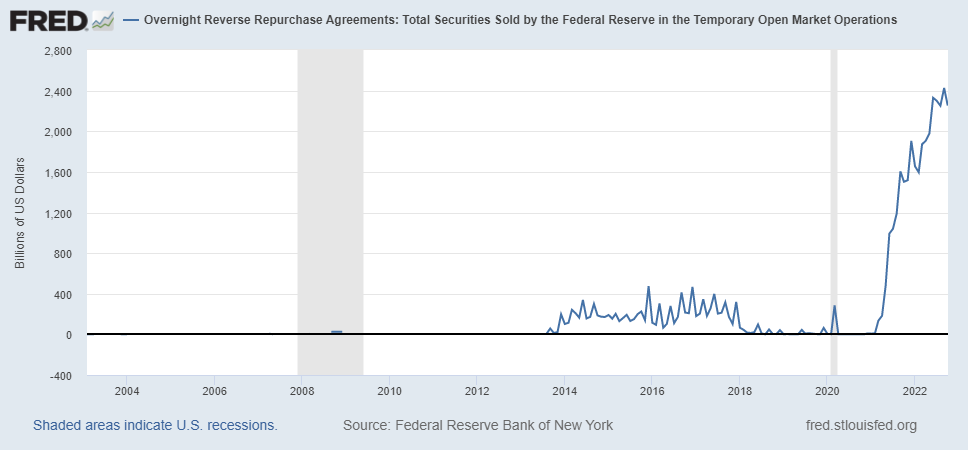

Indeed, the Fed balance has shrunk just a little. Looking at the Overnight Reverse Repurchase Facility (ON RRP), the billions of dollars that are literally parked there and getting 3.05% has skyrocketed.

Investors have $4.6 trillion stashed in US money market mutual funds, while ultra-short bond funds currently hold about $150 billion. And the pile is growing. Cash saw inflows of $30 billion in the week through Sept. 21st, according to figures from EPFR Global.

Investors have really few reasons to deploy capital into risky assets, even considering the high inflation.

Also, according to Fed data there are ANOTHER $18 trillion in deposits at US commercial banks, and US banks are sitting on more than $6 trillion of surplus liquidity, meaning that they do not know what to do with this cash as investing and loans do not look appealing. In 2008, with a completely different economy, surplus liquidity was $250 billion, some cash had been printed there…

Nevertheless, the spread between what banks are paying on deposits and what money market funds are offering is becoming wider and wider and is pushing the usage of RRP facilities even higher.

I somehow believe that a reduction in RRP counterparty caps could possibly be the most efficient method of encouraging a cash movement. As we move into a new state of the economy, with non-conventional monetary policies becoming conventional and public debt simply increasing, we might have both elevated RRP balances and reserve scarcity going forward.

Will things break at some point?

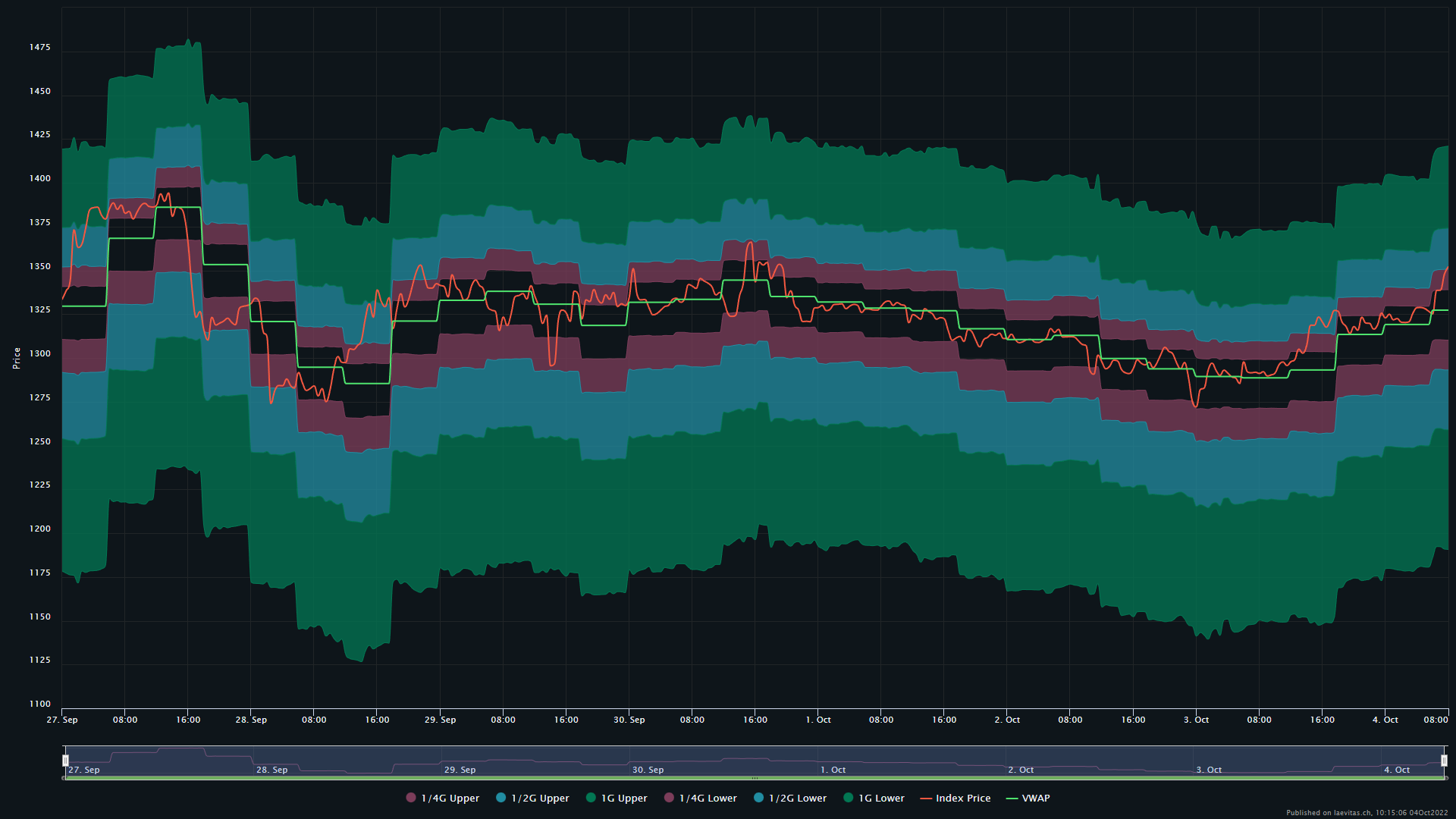

Looking at ETHUSD, we are now just above the $1,200 support. 30-day Realised Volatility is trading at 80%, and the 30-day ATM Implied Volatility is trading at 82%. As we are now trading around the median of the one-year historical volatility, a lower volatility is reasonable (i.e. around 70%).

Looking at the ETH Gamma Bands, we are now in the upper 1/2G, thus a short-term reversal is expected.

Nevertheless, support is $1200 and resistance at $1750